What Are the Major Strengths of Monetary Policy

Suppose you are the governor of the Bank of Canada and the economy is experiencing a recession what changes in a open market operation and b overnight loan rate and bank rate would you consider. What are the major strengths of monetary policy.

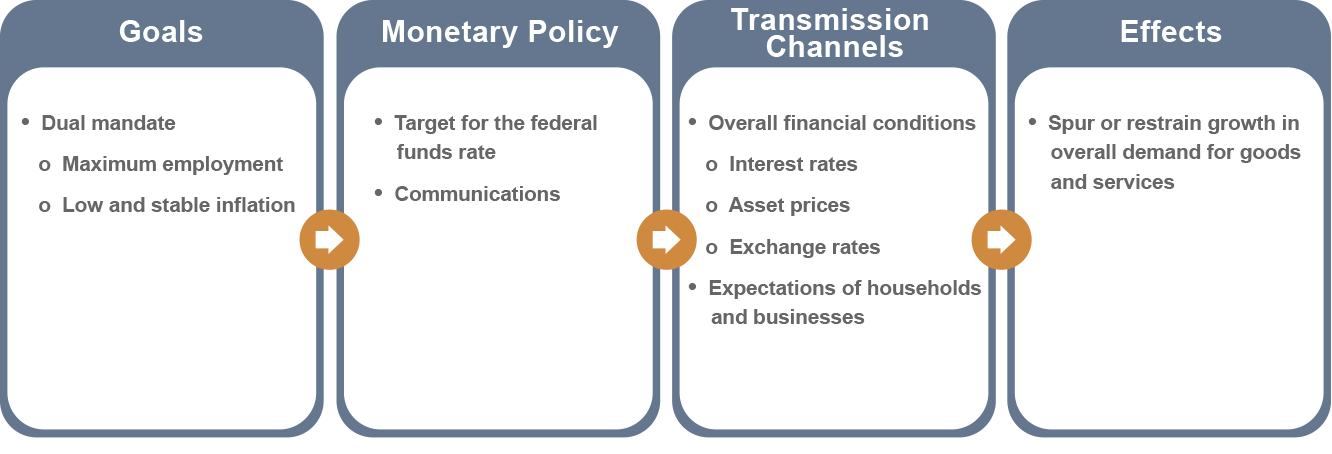

Federal Reserve Board Monetary Policy What Are Its Goals How Does It Work

The major strength of a monetary policy is to stabilize prices.

. Inflation harms the value of money by reducing its purchasing power. The Federal Reserve may remove money out of circulation by selling government bonds or raise the short term interest rates. Most central banks also have a lot more tools at their disposal.

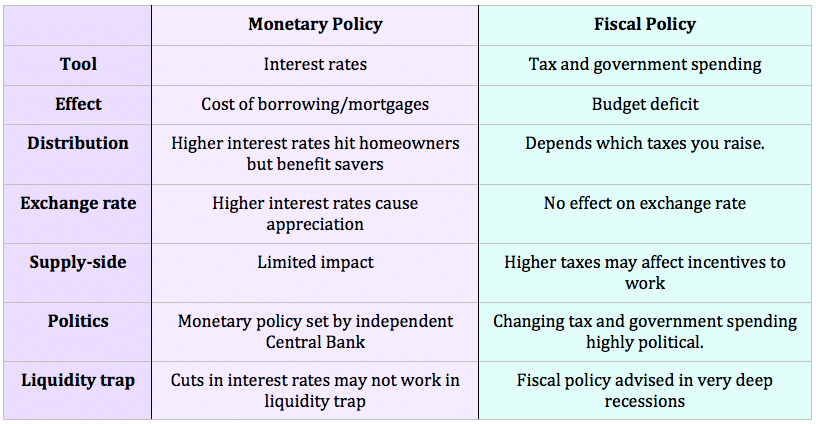

Objective of monetary policy is too help the economy reach a full level of employment The strengths of this policy are its flexibility and speed as opposed to fiscal policy Monetary policy is easier to conduct because of less administrative hold up. Why is the monetary policy easier to conduct than fiscal policy. The major strength of monetary policy is its speed and flexibility The Monetary policy is easier to conduct than fiscal policy because monetary policy has a much shorter administrative lag than fiscal policy Explanation.

Strengths Weaknesses of Monetary Policy Strength. The major strengths of monetary policy are its speed and flexibility compared to fiscal policy the Board of Governors is somewhat removed from political pressure and its successful record in preventing inflation and keeping prices stable. Introduction The success of a countries economy is dependent on several factors.

Monetary authorities work through the money supply and can use open market operations their own lending rates and reserve or cash ratios to influence. The main tools of monetary policy are changes in interest rates. When the rate of inflation rises higher than expected.

100 4 ratings for this solution. View the full answer Previous question Next question. What are the major strengths of monetary policy.

The major strengths of monetary policies are. Monetary policy does not have to go through the political process since it is controlled by the central bank Central bank independance The central bank can make decisions that are best for the economy without political constraints No crowding out Monetary policy does not crowd itself out Ability to adjust interest rates incrementally. One of the biggest perks of monetary policy is that it can help promote stable prices which are very helpful in ensuring inflation rates will stay low throughout the country and even the world.

Explain why a single commercial bank can safely lend only an amount equal to its excess reserves but the commercial banking system as a whole can lend by a multiple of its excess reserves. The monetary policy is the act of regulating the money supply by the Federal Reserve Board of Governors currently headed by Alan Greenspan. With these two parts of the monetary policy countries are able to influence their inflation.

Price stability is one of the most important objective of monetary policy because fluctuation in the price level brings distortion in the equilibrium level of. Emerging market economies are bracing up to contend with swift shifts in risk sentiments and tightening of global financial. They encourage higher levels of economic activity.

Food and beverages inflation was the main driver rising to 75 per cent in March from 59 per cent in February the RBI report said. Explain in each case how the. One of which is the monetary policy.

The basic ojective in other words is to try to have more jobs for people without having to deal with high inflation. Monetary policy is the other main tool that governments can use to influence the economy. Stabilization of prices- Nations are always severely affected by inflation especially when it gets out of hands because inflation hurts the nations currency leading to reduced purchasing power.

Monetary policy has a long effect lag as it works indirectly through the transmission mechanism to reduce or increase aggregate demand. Inflation harms the value of money by diminishing its purchase power. Why is monetary policy easier to conduct than fiscal policy.

Open market operations the discount rate and the reserve requirement. Why is monetary policy easier to conduct than fiscal policy. Ineffective During a Trough.

To combat this the RBA often makes cash rate decisions based on the mid-term economic outlook rather than a short-term outlook. The Fed has three tools to manipulate the money supply. Expert Answer 100 1 rating The basic objective of monetary policy is price stability and maintaining high employment.

The objectives of sustainable economic growth and low inflation often conflict. Strengths And Weaknesses Of Monetary Policy. Changes in reserve requirements how much reserves banks need to keep and open market operations which is the buying and selling.

List of the Advantages of Monetary Policy Tools. What are the major strengths of monetary policy. One of the main responsibilities of the Federal Reserve System is to regulate the money supply so as to keep production prices and employment stable.

What is the basic objective of monetary policy. Monetary policy tools encourage consumer activities based on the current status of the economy. Three Tools Banks Use to Control the World Economy Central banks have three main monetary policy tools.

Also to know is what are the 3 main tools of monetary policy. The major strengths of monetary policy are the speed and flexibility with which it can be implemented and the relative independence of the central banks which oversee it. The monetary policy can achieve a wide range of goals by simply altering either the supply of money interest rates or both.

Step 1 of 4. The major strengths of monetary policy are its speed and flexibility compared to fiscal policy that the Board of Governors is somewhat removed from political pressure and its successful record in preventing inflation and keeping prices stable. Strained supply chains and the quickening pace of monetary policy normalisation.

The basic objective of monetary policy is to assist the economy to achieve price stability full employment and economic growth. When a stimulus is necessary to keep growth happening then banks can lower their interest rates on lending products to encourage additional spending.

Uk Monetary Policy Economics Help

Comments

Post a Comment